Articles

Growing Discontent over China’s Belt and Road Initiative in Nepal

Sub Title : China’s BRI is often in the news for wrong reasons; this time the trouble is brewing in Nepal

Issues Details : Vol 18 Issue 3 Jul – Aug 2024

Author : Defstrat Editorial Team

Page No. : 48

Category : Geostrategy

: July 29, 2024

Protests at the China-built Pokhara International Airport in Nepal highlight increasing dissatisfaction with China’s Belt and Road Initiative (BRI). A large number of activists and locals, led by the National Unity Movement, accused the BRI of being a tool for Chinese intervention and demanded an investigation into corruption and conversion of Chinese loans into grants.

The recent protests at China-built Pokhara International Airport in Nepal have spotlighted growing discontent with China’s Belt and Road Initiative (BRI). Over 200 activists and locals, led by the National Unity Movement, decried the BRI as a tool of Chinese intervention, demanding a full investigation into corruption during the airport’s construction and calling for the conversion of Chinese loans into grants. The demonstration, coinciding with a parliamentary committee’s visit to inspect alleged embezzlement, underscores fears of Chinese dominance and financial entrapment, drawing parallels to Sri Lanka’s Hambantota Port and Pakistan’s Gwadar Port. This unrest reflects broader concerns about the quality of Chinese-funded projects, debt sustainability, and geopolitical tensions, particularly with neighbouring India.

China has become a major financier for many low- and middle-income countries through its Belt and Road Initiative (BRI), but details about its international development finance are kept secret. This lack of transparency makes it hard for countries to evaluate the pros and cons of joining the BRI. A new dataset reveals $843 billion spent on 13,427 projects across 165 countries. China’s international development finance surpasses that of the US and other major powers, averaging $85 billion annually. Unlike grants, China primarily uses debt to wield influence, maintaining a 31-to-1 loan-to-grant ratio under the Belt and Road Initiative (BRI). This strategy helps address domestic challenges like surplus foreign currency and industrial overproduction. Chinese loans often require sourcing materials from China and repaying with natural resource exports, but terms are less favourable than those from OECD-DAC and multilateral lenders, with an average 4.2% interest rate a grace period of less than two years, and a maturity length of less than 10 years this interest is very high for any under developed or developing country.

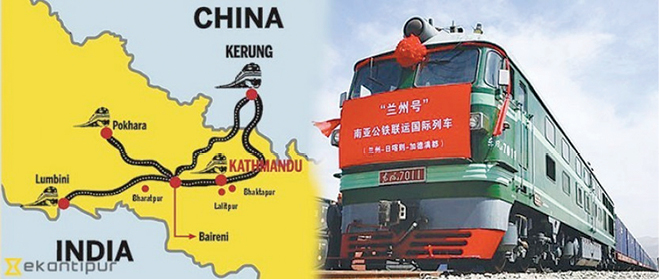

The Belt and Road Initiative (BRI) has largely failed in Nepal, as confirmed by Prime Minister Dahal’s recent visit to China on 30 Sep 2023. Despite signing the BRI MoU in 2017, Nepal and China have not executed any significant projects under its framework. Nepali leaders prefer grants over China’s proposed soft loans, reflecting concerns over debt traps. Protests and skepticism have arisen due to issues like embezzlement and poor construction quality at China-built Pokhara International Airport. China’s reluctance to address Nepali economic concerns and press new initiatives without resolving existing issues has further strained relations. The BRI’s failure is evident as major projects are awarded to Indian companies instead, highlighting the project’s inadequacies and Nepal’s cautious approach.

Paul Haenle from the Carnegie Endowment for International Peace highlights the Belt and Road Initiative’s (BRI) deficiencies in transparency and sustainability. He contends that the initiative’s execution is frequently plagued by corruption and poor governance, resulting in mismanaged and substandard projects. These issues not only diminish the quality and effectiveness of BRI projects but also exacerbate the debt burdens of participating countries. Haenle calls for improved oversight and governance to enhance the initiative’s long-term benefits.

The Foreign Policy Research Institute echoes critiques of the Belt and Road Initiative (BRI), highlighting its deviation from its original goal of promoting global trade and economic cooperation. Instead, the BRI is now seen as a tool for Chinese geopolitical leverage, undermining trust among international partners. This shift from its initial vision has contributed to the initiative’s struggles, compounding issues of transparency and sustainability, and leading to concerns about China’s intentions and the initiative’s true objectives.

Several prominent economists have criticized China’s Belt and Road Initiative (BRI), pointing out significant flaws. Experts from the Council on Foreign Relations highlight poor risk management and a lack of coherence among the Chinese enterprises involved as primary issues. These deficiencies have resulted in numerous projects experiencing delays, budget overruns, and subpar outcomes, damaging China’s global reputation. The BRI’s initial promise of fostering international trade and economic cooperation has been overshadowed by these challenges, leading to increased scrutiny and skepticism about China’s true intentions and the initiative’s long-term viability (Council on Foreign Relations).

Recent reports highlight multiple reasons for the failures of China’s Belt and Road Initiative (BRI), attributing them to poor governance, corruption, and strategic miscalculations. Corruption and governance issues plague projects like the dry port of Khorgos in Kazakhstan and the Hambantota port in Sri Lanka, where local elites siphon off funds, leading to delays and subpar outcomes. The financial model, relying on high-interest loans, has increased debt burdens and financial instability in countries like Zambia and Sri Lanka. Political and economic instability, such as in Pakistan’s Gwadar port, hampers progress due to a lack of investment and necessary infrastructure. In Nepal, strategic misalignment and unclear funding mechanisms have left major projects unexecuted, causing disillusionment on both sides.

The Belt and Road Initiative (BRI) has faced significant challenges, highlighting its deficiencies in governance, transparency, and strategic execution. Reports of corruption and mismanagement in projects like the dry port of Khorgos, Hambantota port, and Pokhara International Airport reflect systemic issues within the BRI framework. The high-interest debt model has increased financial burdens for countries like Zambia and Sri Lanka, exacerbating economic instability and skepticism about China’s intentions. Political instability, as seen in Pakistan’s Gwadar port, and strategic misalignments in Nepal further illustrate the initiative’s struggles. Critics emphasize the need for improved oversight and governance to enhance the BRI’s long-term viability and restore trust among international partners. Without significant reforms, the BRI’s goals of promoting global trade and economic cooperation remain overshadowed by these persistent challenges.