Articles

Vadhavan and Vizhinjam port projects boost ‘Maritime Amrit Kaal Vision 2047’

Sub Title : Commentary on two new ports of strategic importance

Issues Details : Vol 18 Issue 3 Jul – Aug 2024

Author : Dr Vijay Sakhuja, Former Director, National Maritime Foundation

Page No. : 14

Category : Geostrategy

: July 29, 2024

Prime Minister Narendra Modi’s ‘Maritime Amrit Kaal Vision 2047’ aims to develop world-class ports, enhance inland water transport, coastal shipping, and promote a sustainable maritime sector. Recent port projects like Vadhavan and Vizhinjam support this transformative vision for India’s maritime infrastructure.

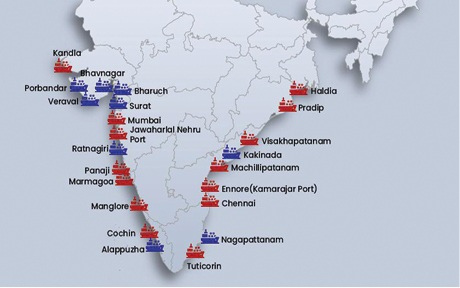

Prime Minister Narendra Modi launched the ‘Maritime Amrit Kaal Vision 2047’ early this year. The Vision document, prepared by the Ministry of Ports, Shipping & Waterways, aims to develop world-class ports and promote inland water transport, coastal shipping, and a sustainable maritime sector. Earlier in 2023, Shri Sarbananda Sonowal, Minister of State for Ports, Shipping, and Waterways announced a comprehensive plan to achieve a 10,000 MTPA port capacity by 2047, the establishment of a Bureau of Port Security, and building hydrogen hubs at Major Ports. During the last few years, the Indian ports have improved key operational performance parameters and are making steady progress in their throughput.

Two recent port related developments are catalysts for the ‘Maritime Amrit Kaal Vision 2047’ as well as support trade through mega continental connectivity corridors. These port projects will also bring value to the container traffic in the country given that nearly 75 percent of India’s transshipped container cargo is handled by ports outside India.

Vadhavan Port

First, the all-weather-deep-draft Vadhavan port, located on India’s west coast in Palghar district, Maharashtra. It is being developed at a cost of Rs 76,220 crore for which the cabinet approval was announced in June 2024. The project involves sea-land reclamation of 1,448 hectares which in effect eliminates the need for land acquisition. A 10.14 kilometers long breakwater surrounding the port will provide the ships in the harbour the much needed safety against tides and storm surges. It is planned to build nine container berths, (1000 meters long), four multipurpose berths, four liquid cargo berths, a Ro-Ro berth, and a Coast Guard berth. The port is a joint venture between JNPA (74%) and the Maharashtra Maritime Board (MMB) (26%) and is expected to be operational by 2030. According to reports, after completion of the second phase of the port project i.e. by 2040, the port will handle 23.2 million TEUs of cargo.

The port is labelled as “behemoth” ! This is so due to the fact that it dwarfs other Indian ports i.e. “over three times the size of the Jawaharlal Nehru Port Authority (JNPA) in Mumbai and the Adani-owned Mundra”. As regards its cargo capacity, the port is capable of accepting large container vessels with carrying capacity of 24,000 containers.

Minister for Ports, Shipping & Waterways Sarbananda Sonowal has proudly announced that Vadhavan a “mega port infra for New India”, and would “strengthen India’s maritime prowess.” Geo-economically, this port can catapult India “as a hub port in the Arabian Sea, strategically serving container traffic destined for the Gulf, Europe, and even African countries” as also be among the top ten ports of the world.

It merits mention that in India among the 12 large ports and 16 private ports, only two ports i.e. Jawaharlal Nehru Port (ranked 27) and Mundra Port (ranked 26), are listed in the top 50 container ports in the world. Below is the list of top 8 container ports in the Indian Ocean region.

Vizhinjam

The second port under discussion is the deep-sea Vizhinjam Port. It is located on the west coast of India about 16 kilometers south of Thiruvananthapuram district of Kerala. The port has been built with a total investment of Rs. 18,000 crore, including Rs 8,867 crore for the first phase. The existing infrastructure includes 600 meters of operational jetty and 7,500 container slots in the yard are being prepared to accept cargo. The turnaround time at the port is expected to be around 24 hours. It is estimated that the port would be able to handle 1 million TEUs initially, expanding to 3 million by 2028, and ultimately reaching a capacity of 5 million TEUs.

Early this month in July 2024, Vizhinjam Port received its largest vessel i.e. 300-meter-long container vessel MV San Fernando which is operated by Maersk. According to Aniket Dani, Director- Research, CRISIL Market Intelligence and Analytics, “This transshipment port’s development will make India’s trade more efficient, cost-effective, and less vulnerable to geopolitical tensions, allowing the country to take a larger share of cargo and container volume from dominant players in the industry. Domestically, the port will be well-connected to a 4-lane NH66 highway and proposed freight corridors and is just 16 km from Trivandrum International Airport,”

Vizhinjam Port project is a public-private partnership (PPP) initiative between The Kerala government and Adani Ports and SEZ Limited (APSEZ). The partners are expected to invest Rs 20,000 crore to develop the transshipment hub with all four phases to be completed by 2028-29.

Connectivity Corridors

Vadhavan port, according to the Indian Government, will be a world-class maritime terminal and can “promote public-private partnerships (PPP) and leverage efficiencies and modern technologies to create a state-of-the-art terminals capable of handling mainline mega vessels plying on international shipping lines between the Far East, Europe, the Middle East, Africa and the Americas”.

Vadhavan can potentially plug into continental connectivity corridors such as the IMEEC (India Middle East Europe Economic Corridor) and INSTC (International North South Transportation Corridor). Amitabh Kant, India’s G20 Sherpa has noted that the Vadhavan port could be the “starting point” and “serve as a doorway for India’s trade with Europe and the Gulf region,” Furthermore, “It will also serve as a cost-efficient gateway for India’s trade with Central Asia and Russia via the International North – South Transportation Corridor (INSTC).”

The IMEEC project has moved forward from the drawing board-conceptual stage; early this year in February, India and the UAE signed the first formal agreement and by June discussions had begun to onboard the port authorities (Mundra, Kandla and Nhava Sheva and Jebel Ali and Fujairah in the UAE) to digitize vessel and cargo clearances documents and harmonise vessel-voyage-cargo procedures between the ports. The European Commission statement notes that the IMEEC will “integrate rail lines and port connections from India to Europe”. Meanwhile, France has appointed Gérard Mestrallet, a former CEO of Engie and ex-president of Suez, as the “special envoy”.

Notwithstanding these positive developments, IMEEC attracts multiple hurdles and challenges. The heightened regional tensions marked by the ongoing Israel-Hamas conflict and the threat of attack on the Haifa port by the Houthi rebels are significant issues before making calls for investments. Besides, each of the partners (Initial MoU was signed by the United States, the European Union, France, Germany, Italy, India, the United Arab Emirates, and Saudi Arabia) have respective geopolitical and geostrategic interests in the region which will necessarily have to be addressed.

Unlike the IMEEC, the INSTC has made significant progress. In May 2024, agro products (oat flakes and cereals) were shipped (train-ship-road-ship) from the Yuzhnouralsky Transport and Logistics Center in Chelyabinsk region in the Urals to Bandar Abbas port in Iran to India in about 35 days via the INSTC. It is estimated that transportation of agricultural goods along the INSTC could increase to 100,000 tonnes annually. Russia is also planning to export coal to India through the INSTC via Bandar Abbas. On its part, the Islamic Republic of Iran Shipping Lines (IRISL) has announced that it has earmarked 300 containers for shipment of goods from Russia to India and vice versa in the first phase, and the numbers could increase in the future depending on the cargo demand. Also, India has secured 10-year contract to “develop and operate” the Shahid Beheshti Port Terminal in the Chabahar port in Iran.

Vizhinjam port lies astride the major shipping route of the Indian Ocean and a short diversion of just 10 nautical miles makes it strategically important for cargo transshipment as well as necessary logistics. It not only serves national requirements by linking with national-regional road-rail network, it is a gateway to the wider Arabian Sea-Indian Ocean trade (South Asia, Persian Gulf, east coast of Africa and Southeast Asia) and has the potential to boost India’s share in international trade. Also, Vizhinjam natural draft of above 20 meters makes it an attractive destination for port calls by ultra-large container vessels having capacity of more than 15,000 TEUs.

Vizhinjam can set up continental connectivity corridor through Chabahar in Iran through the Middle Corridor or the Trans-Caspian International Trade Route (TITR). The TITR is supported by the European and international financial institutions who have pledged to invest roughly US$10.8 billion for developing infrastructure along the route. The EU’s interest in the route are quite obvious and is triggered by the Russia-Ukraine war and sanctions which has reduced dependence on the Northern Corridor route which passes through Russia.

Concluding thoughts

It is true that India has few deep water ports and it needs to invest in maritime infrastructure. In that context, Vadhavan and Vizhinjam port projects are strategic additions and complement the ‘Maritime Amrit Kaal Vision 2047’ which envisions port-led industrialisation, enhancing coastal shipping, reviving inland waterways, and making India Atmanirbhar in shipbuilding, repair & recycling.